Have you ever thought about what you’d do if an unforeseen loss gets accredited to your name or company? What if you get sued a neighbor who was cycling and fell due to the water you forgot to mop off your pavement. He sues you for all his medical bills and for his damaged bike which apparently was a collectible. Ever thought of what you’d do next? How would you cover so many costs?

In an unfortunate event like this where you didn’t cause any damage to the other party personally but were indirectly at fault, what would you do to cover all the extra costs? Since we can’t predict what would be the outcome in a court case, it is important to be protected at all times. A Florida umbrella insurance policy is no longer a need for the wealthy only, but for the common man too.

WHY SHOULD FLORIDA RESIDENTS CONSIDER UMBRELLA INSURANCE?

In Florida, Umbrella insurance is certainly important for every individual policy holder because life in Florida is quite different from the rest of the states in the country. Apart from the luxurious beaches and awesome night life, the downsides to living in Florida are the natural disasters that affect the state frequently.

Residents of Florida end up losing their homes in the turbulent weather that arises from hurricanes and floods. An insurance policy is an additional layer of protection that covers you and your family throughout the situation.

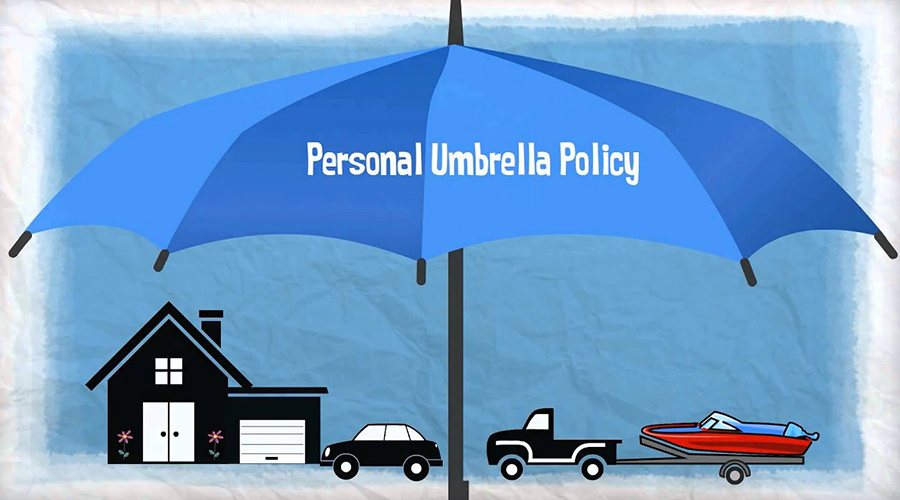

Additional costs like evacuation, rebuilding houses from scratch with new belongings requires an extra coverage that is not provided by your regular homeowners insurance. These extra coverage costs can be covered through an umbrella insurance policy

WHAT UMBRELLA INSURANCE POLICIES ACTUALLY COVER?

- Protection from major claims and lawsuits

- Rental property you own

- Slander

- False arrest and imprisonment

- Injuries caused by you intentionally or unintentionally